Roberto Fabelo’s Auction Triumphs: Rising Demand Amidst Scarcity

Cuban artist Roberto Fabelo continues to captivate the art world, with his recent auction results underscoring both escalating demand and the increasing rarity of his works. In March 2024, Fabelo’s monumental triptych Arte culinario achieved a record-breaking sale of $630,000 at Christie’s New York, marking the highest price ever fetched for his work at auction .MutualArt+2Beyond Artist+2Beyond Artist+2 This sale is part of a broader trend highlighting Fabelo’s growing prominence. His 2018 triptych Perrerío sold for $579,600 at Christie’s Latin American Art sale in March 2022, setting a new auction record for the artist at that time . These significant sales reflect a robust market interest in Fabelo’s unique blend…

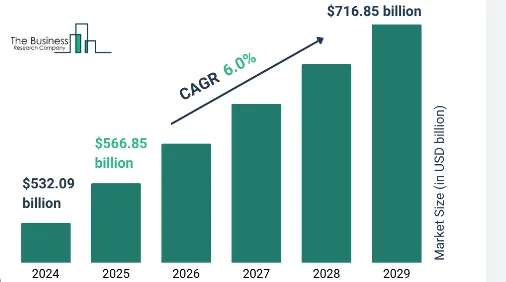

Refuge in the Art Market 2025

Graph by The Business Research Company The Art Market: A Safe Haven Investment in 2025 The art market is increasingly regarded as a “safe haven” investment, particularly during times of economic uncertainty. This perception is reinforced by the historical resilience of art values against inflation and market volatility. Recent reports highlight that fine art is viewed as a strategic asset for wealth preservation, with 32% of billionaires planning to increase their exposure to fine art and antiques in 2024-2025. The Role of Technology in Art Investments Technology has significantly transformed the art market. Blockchain technology is now widely used for provenance verification and fractional ownership, making high-value art accessible to…

The Rise of Cuban Art on the Global Market

The Value of Cuban Fine Art in 2025: Spotlight on Roberto Fabelo Cuban art has long been celebrated for its rich history and unique blend of cultural influences, but recent years have seen a surge in its global appeal. This growth can be attributed to increased international interest in Cuban culture, improved access to Cuban artists’ works, and the easing of restrictions on trade and travel. Auction houses such as Phillips and Christie’s have played a pivotal role in bringing Cuban art to the forefront of the global market, showcasing both established and emerging artists. Roberto Fabelo, a master of surrealism and storytelling through art, has emerged as one of…

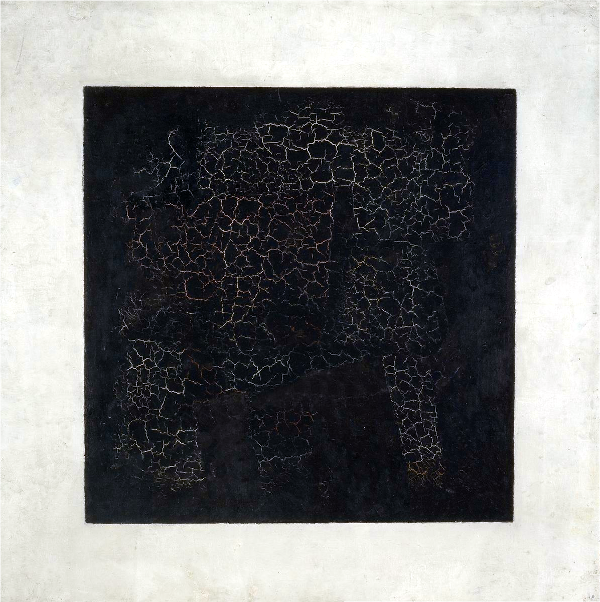

How to Verify the Provenance of Russian Art

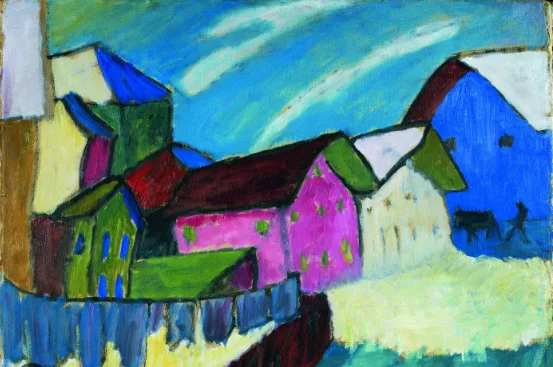

Due Diligence in a Market Rich with History—and Complexity The Russian art market is one of the most intriguing—and most carefully scrutinized—in the world. With masterpieces from artists like Malevich, Kandinsky, and Kljun commanding millions, provenance is not just a formality: it’s a necessity. So, how do seasoned collectors verify that a work is the real thing? 1. Start with Documentation, Not Assumptions A serious seller provides a chain of ownership. This includes previous auction records, gallery sales, exhibition catalogs, and references in scholarly publications. If the paperwork starts after 1990, be cautious—many fakes emerged during the Soviet art “rediscovery” wave. 2. Check for Expert Attributions and Catalogues Raisonnés Reputable…

Fine paintings & art for sale

Invest in Art. But be selective. With some names you can never go wrong like Chagall, Brancusi, Kazimir Malevich, Pirosmani, Canaletto, Kandinsky, Renoir, Moglidiani and Gudiashvili. Yes, we do have some of their original works. VIP access. But, we also have over 2000 original art objects available or access to, in many cases directly from the owners who often bought most of them from the artists or from the families of the artists themselves: the Pissarro family, Yuroz, Michal Zaborowski, Alexandra Nechita, R.C. Gorman, Robert Hagan, Nicolai Timkov, Fedor Zakharov, Vladimir Krantz, Dmitry Maevsky and many other excellent Russian Impressionists as well as impressionist-inspired original paintings and bronze sculptures, French, American and Russian…

Fine art’s market value

Why are original artworks so interesting for investors? Beside increasing in value, art can be used as collateral. What are the requirements and considerations? What are the characteristics of fine art that makes it a viable alternative security? Let’s analyze the appreciation of art in the course of time, because collecting and owning it can be compared to the stock market. When we examine the value of art in the context of current national and international economy, we draw lessons from the power of art in former economies and project what this may mean for the future. As a reader of Forbes you know what “market values” are. When wars or revolutions…